A workflow is a plan of step-by-step processes that lead to the completion of a task or project, and can then be repeated. There are several different ways to design a workflow, as well as tools that can help. In this post, we’ll focus on the accounting industry and how workflow management is essential to building a successful accounting firm.

Why workflow design is important

But why do workflows matter? Here’s why you should consider designing them in your business.

Increased visibility over your business

In larger accounting firms, “silos” are a problem. A silo is where one team keeps data, systems, and processes to itself, without sharing them with other teams in the organization. This means within the same company, you’ll find teams working towards different goals and with different processes. This lack of consistency can have far-reaching negative effects on the business: teams need to be unified, working to achieve the same objective and following the same processes. Often, different teams don’t share information about their workflows because they simply don’t have them mapped out. By designing different workflows, businesses increase visibility over their systems and processes, allowing for improvements and uniformity across the firm.

Automated onboarding

Traditionally, new client onboarding was a lengthy process, involving meetings, troubleshooting, and teething problems. Slow onboarding processes are risky, as it means clients may take longer to see the benefits in an accounting firm’s service. And that could have a negative impact on customer retention. And from the business’ point of view, onboarding is a repetitive task that takes up an accountant’s time, taking them away from billable work. By automating onboarding processes, businesses will improve the customer experience and increase retention. It also saves employees time, freeing them up to work on billable tasks.

Improved Service

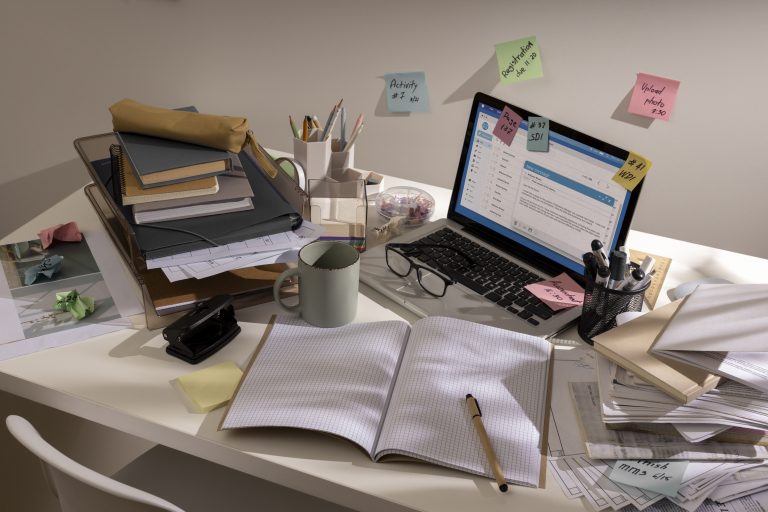

Unclear workflows are prone to human error, delays, and poor quality outcomes. Professionals from across the accounting practice, including Certified Public Accountants (CPAs), have to stay on top of their workloads while juggling multiple clients. A lack of clear systems and processes may mean they forget certain tasks and drop the ball. After all, this happens to the best of us when we’re busy, right? And new employees will take longer to learn new workflows, slowing them down in their dealings with the client. Frequent mistakes can lead to poor quality deliverables and dissatisfied clients, negatively affecting their experience and making them go elsewhere. By designing a workflow, each step in the process is mapped out, making it easier for accountants to systematically complete their client’s project without missing steps, improving the client experience.

Increased productivity

In many accounting firms, processes are undefined and each accountant has their own way of carrying out their tasks and managing their clients. This lack of transparency is a problem for businesses, as it doesn’t allow them to see where processes can be improved or automated. And this is important in the accounting industry, which typically has lots of granular and outdated processes. By designing a workflow, businesses map out, step by step, their processes which allow for greater visibility over their operations. This means managers can identify weak, outdated, or time-consuming points, removing or automating them to improve productivity.

Methods to creating workflow design

At first, the thought of having to map out each little step in your business’ processes may seem daunting. It’s a big task and one that shouldn’t be rushed. There are several different methods firms can follow to map out their workflows, here are some of the most effective:

Written processes

This is perhaps the most frequently used way of creating workflow design in accounting firms, and businesses in general. Using Google Docs or Microsoft Word, accountants manually type out step by step, their processes which are then shared with colleagues and saved to the drive. Traditionally, in larger firms, these documents even take the form of manuals and guides, printed out and filed away in offices.

While documented workflows do work well, they have their limitations and have become a little outdated:

They don’t provide a real-time view of the business. Accounting firms are dynamic and projects are different. Manually produced documents detailing processes can’t reflect all these variables. Therefore these workflows can’t be used in all cases and may contain gaps and weak points. This increases the chances of human error and poor-quality deliverables.

Keeping them up-to-date and consistent is difficult. Manually created workflow designs need to be updated manually too. This is time-consuming for the employee who has to do it and can also lead to inconsistency and errors. The master document can be confused with other drafts, creating more tedious work and potentially causing more workflow errors.

Online tools

Accounting firms have a wide number of online tools available to help streamline certain workflows and steps within processes. For example, Quickbooks online is accounting software that helps with invoicing and billing, removing the need to manually create client financial documents. While Slack has unified communication within teams.

These apps undoubtedly speed up processes for accounting firms, but they do have a big downside:

They don’t cover the whole process. Accounting software automates the creation of invoices, but what about the follow-up for payment? Slack’s great for team communication, but what about with clients and collaborators? While these tools are great for each micro task, using a wide range of different software can confuse team members and bottlenecks between processes.

Workflow Management Software

Another method to designing accounting workflows is by adopting workflow management software, like COR. Workflow tools unify all processes and streamline them into one platform, improving efficiency and productivity. Tasks are assigned through workflow management software, automating the creation of to-do lists for teams and individuals. This means team members no longer need to rely on handwritten lists or use other task management tools, improving efficiency and driving productivity.

Why Every Accounting Firm Needs a Workflow Management Software

Since the start of the Pandemic, digital transformation has accelerated across the professional services industry and accounting firms are needing to adapt and evolve to changing client demands. They have to be agile and transparent to win new business and stay in the market. They need efficient processes and product teams to ensure profitability, and that’s why they need workflow automation software.

As we’ve already discussed, these tools automate tedious tasks and streamline workflows into a single platform. This is why every accounting firm needs workflow management software:

Increased client retention. First impressions are everything, and that’s why smooth onboarding of new clients is essential to an accounting firm’s long-term success: happy clients mean repeat and referral business. By using workflow management software to ensure team member availability and client integration, accounting firms make their onboarding process more efficient. This improves the client experience which helps boost retention.

Automation of time tracking. Time tracking is important to us at COR as it helps ensure professional service firms earn the correct fees for the quality work they produce. Without time tracking, accounting firms have no real visibility over how long different projects take, making it difficult to budget and set pricing. Scope creep is another problem faced in project management that affects a given project’s overall profitability.

More efficient resource management. Traditionally in accounting firms, managers would have to contact their team members one by one to see if they have the capacity for future tasks. Waiting for each team member to reply can be time-consuming, and also prone to error: sometimes team members take on more work than they should. Through streamlined task assignment, workflow management software allows managers and team members to see their capacities in real-time, speeding up the delivery of a project and avoiding saturating team members.

Streamlined communication and document management. Workflow software, like COR, removes the need for multiple channels of communication, allowing a firm to simplify client communication. It also allows for firms to save time and keep client information secure through bookkeeping integration. This helps improve operations within the practice management by ensuring clear communication and accessibility of project documentation.

Automated business intelligence. Many workflow management systems, including COR, leverage artificial intelligence to analyze data quicker than ever before. This helps accounting firms speed up their business processes, as important data, like metrics and financial reports, are now automated. This facilitates intelligent, data-driven decision-making and allows for fast reporting and completion of tax returns, for example. If you’re interested to learn more about financial reporting, click here.

Automated project creation. As we defined at the start of the post, a workflow is repeatable and therefore can be applied to several processes and projects. Workflow tools, like COR, provide project managers the functionality of creating templates for certain types of projects, speeding up delivery.

Conclusion

As digital transformation continues to change the way we do business, workflow automation will be essential for achieving profitability in the accounting industry. Internally, it allows for more efficient processes by removing time-consuming, repetitive tasks. This frees up team members’ time, allowing them to spend more time in billable activities. And workflow automation means a better client experience which helps increase retention and drives organic growth.