What is enough to get your brand noticed and drive appropriations for projects? How much is too much to generate a meaningful return on investment? Here’s what you should know about developing an agency budget.

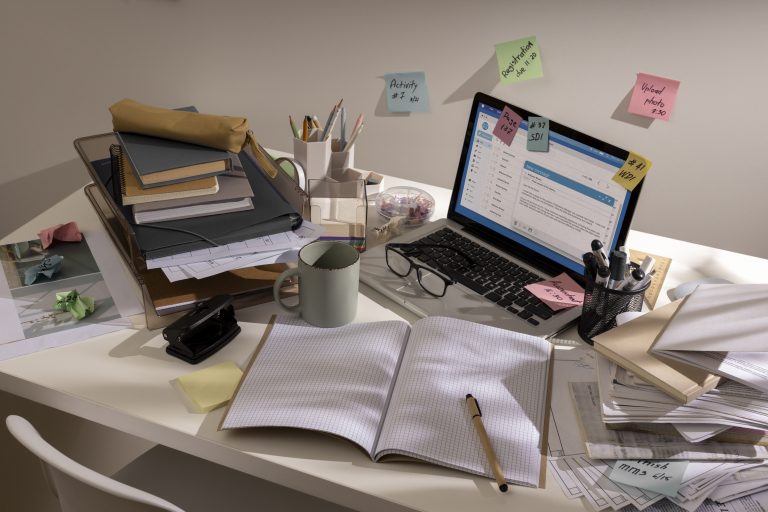

Running an agency is by no means, an easy task. You have to go through a tiring process to acquire the right type of clients that want the solution you offer. At the same time, you have to hire employees to build the best team to render your services. On top of that, you have to put a system in place to ensure seamless collaboration between your team members for maximum productivity. Add to that the agency’s finances and the planning stage, and the human resources.

Strategic planning is a long-term-oriented process of assessment, goal setting, and decision-making. It includes a multilayer view of objectives and strategies for accomplishing agency goals. The strategic planning process requires each agency to clearly define the results it seeks to achieve and identify factors that drive the program’s performance and influence future planning, resource allocation, and operating decisions.

The strategic planning process incorporates and sets the direction for all agency operations. The process ensures effective long-range planning to maximize the efficient use of state resources to serve the agency’s core mission. The strategic plan is the formal document that communicates the agency’s goal to the staff and other actors such as the government or the legislature.

The plan’s format is intended to enable agency leadership to be concise in developing a strategic vision, agency goals, and action items to achieve those goals. Therefore, the strategic plan should be prepared principally by agency executives. Although a cross-section of agency staff may support the plan development, strategic plan document preparation should not utilize excess agency resources or necessitate outside contractors consultants.

Every agency plan should include a budget request in marketing. Determining a budget for a small business can be especially difficult for those who have never invested in marketing before. In this article, we offer tips to help you understand how to get started with your marketing budget, both in private agencies as well as state agencies, what your marketing spend may look like, how to track your marketing budget, what your marketing spend may look like and how to track your marketing budget, along with some marketing budget templates to serve as a guide.

Remember that the exact amount you should spend on your agency marketing budget will depend on your industry, location, and goals and that doing your research before setting a budget is key.

What is an agency budget?

An agency’s marketing budget is the amount of money a business allocates for expenses related to the promotion of its goods or services. Agency budgets are usually developed on a quarterly or annual basis.

An agency’s budget should be comprehensive and include all of the projects that your team plans to develop in the short and long term. A marketing budget is more complete than an advertising budget, it includes all areas, not just ads.

As for small businesses, this is specifically crucial. Small business owners lack experience in drawing up budgets; moreover, it’s critical that these companies keep costs as low and lean as possible as they scale. Yet these budgets can be difficult to establish for companies of all sizes.

Overall then, it’s an estimated amount required to encourage existing or future products or services with other direct or indirect marketing costs which are already planned for the next financial period. It’s generally a crucial step in the marketing process. This budget process is created to estimate the costs that are necessary for the economic development of the business.

Why do you need a marketing budget?

Budgets for agencies help to avoid future problems. If your campaigns are not properly funded, you can experience low staffing, lack of equipment, and insufficient reach. With a marketing budget, your team can know exactly how much to allocate for staff salaries, office space, equipment, marketing communications, ad design, human services, and more. Thorough research allows you to set the appropriate budget and allocate the right funds per project.

Most businesses have a tough time predicting promotional and funding levels. High capital projects are kept when new products or services are launched in the market as companies have to spend on advertising. The percentage method is used for predicting the budget and the marketing budget is set according to the percentage of sales or profit: It is a critical resource for the entire company because failure to properly estimate costs can lead to various problems.

Some statistics have shown that 85% of small to mid-size companies just operated on a budget without any specific plan ahead of them. That’s why so many marketers are focused on tactically preparing marketing budgets. Budgeting is a difficult process and many companies rely on their last year’s spend as a base for estimating the budget. Marketers also use ROI to prepare the appropriate budget.

Marketing budgets allow you to align your marketing strategies with your business goals. Furthermore, these budgets give your team members the tools they need to funnel money into the campaigns that offer the largest return on investment.

Tips for planning your budget

There is a wide range of marketing agencies’ costing and budgeting initiatives for marketers to consider when outsourcing their appropriation bills of marketing services. Both the private sector and the state sector fees model used will vary by both types of agency and client engagement as you seek to agree on what is a practical, mutually beneficial, remuneration mix. Whichever model you use, an agency or consultancy should ensure that all elements of activities are captured and you minimize working for free in order to secure production work. I say the costing model since it’s common practice for an agency to have a preferred approach, but to vary it on a case-by-case basis depending on clients’ requirements and expectations.

How much you should charge clients for specific elements of work that you undertake will be based on a range of actors as fixed overheads (office rents, management salaries, and so on), variable overheads (use of freelancers), estimated utilization (billable time) rates for each role, the level of margin that you want to apply, etc.

The marketing agency costing and budgeting spreadsheets are built on a time + skill cost model, but agencies can and do have different remuneration agreements in place with clients. To my mind and working with a range of agencies, “time” is still the most common currency used between agency and client though. Charging for labor/effort using a calculated hourly or day rate multiplied by how long that task will take is just one way to look at remuneration.

Whichever model suits you best, it’s essential that you monitor the real amount of effort required to create the solution by recording time accurately.

Here are some tips on better costing and budgeting of your marketing agency budget that are quietly often used to maximize profit:

1) Settle on a costing model

To budget your resources properly, you have to find the best costing model suitable for your agency. Using the wrong costing model for your clients could lead to losses.

Here are some common costing models available to marketing agencies:

- Fixed fee: For this type of cost model, your client will pay a specific amount for a project with clear specifications. For a fixed fee costing model, you have to consider factors like the number of tools needed, personnel involved, and likely completion time before arriving at a value.

- Time-based fee: This is a type of cost model where you charge your clients based on the amount of time it takes to complete the project. This might be the best for consultants who have one-on-one meetings with their clients.

- Value-based fee: Your clients pay based on the value you provide to their business rather than the amount of time you spend.

- Results-based fee: For an agency that’s just growing, this might be a way to attract clients. After all, you only get paid when your clients make money. However, you have to be careful with this model to avoid losing money.

In a nutshell, the simplest costing model to manage your resources equitably is the fixed fee. That’s why it is so popular among agencies.

In the state of the marketing agency report by Wordstream, they found out that 50% of agencies charge their clients a fixed fee.

2) Calculate the fixed overhead cost

For every business, there are fixed recurrent costs during a particular period. Whether you acquire many clients during this period or fail to bring in clients, costs won’t vary.

In other words, your fixed overhead costs for an agency are:

- Rent: Even though agencies do the majority of their business online, it’s necessary to rent an office space. This could as a meeting place with clients as well as a workspace for some of your employees. It also improves local SEO to attract local clients. In a Wix study, agency representatives listed “refocusing on the local market” as one of their biggest growth opportunities.

- fixed salaries: When a worker’s salary is independent of the amount of work they do, this is a part of fixed overhead costs.

- Taxes and Insurance: In most cases, these are fixed costs your agency will incur over a period.

The best practice to manage your agency resources and information technology as well as possible is to minimize your fixed costs and be on the administration lookout. This ensures that when there’s a low amount of work, fixed costs won’t wipe out your savings. Moreover, that information stays where it should be and is seen by the right people.

3) Calculate the variable overhead costs

For an agency, it’s better to maintain more variable overhead costs than fixed overhead costs. Because these are dependant on the amount of work you do during a period.

Examples of variable overhead costs include

- Hiring freelancers: Since freelancers only get paid when they work, the amount your agency pays depends on the amount of work a freelancer does. Many agencies now use freelancers to reduce fixed overhead and overall costs. Through this, you eliminate the costs of a bigger office, furniture, computers, utilities, etc. This is yet again evident in another Wordstrem report where about 70% of agencies have one or no full-time employees dedicated to paid search.

- Utilities: The cost of utilities like electricity and water can vary based on usage during a period.

- Equipment for servicing clients: For your agency, you need to consider both physical and software tools used in providing value for clients.

Calculating variable costs can be more difficult than fixed costs. But it’s necessary to determine your overall costs and find opportunities to cut costs and expenditures.

4) Use a Project Management tool

With a project management tool, you can improve the efficiency of your project execution and oversee performance measures. One of the biggest advantages of a project management tool is that it helps you to track how much time you spend on various types of projects.

As a result of this, you can cut down the time needed to execute a project. This means lower costs for your agency. Furthermore, a project management tool improves collaboration between your team members.

Every team member can see different tasks for a project and the team member responsible for each stage. More so, it’s easy to track every stage of the project from the beginning to the completion.

Don’t overlook the importance of being very organized and ensuring easy communication; a project management tool can genuinely make it easier for you to calculate your costs and make your project execution more efficient. Partnerships with this kind of software make a real difference, don’t miss it.

5) Perform analysis of different marketing channels and their requirements

If you’re running a marketing or advertising agency, there are many channels your clients can use to promote their business. However, each channel requires a unique strategy to acquire the best results and fulfill each and every one of the agency’s missions.

Some marketing channels your agency might use to promote your client’s businesses are:

SEO: This involves marketing businesses on search engines. Prospects searching for a client’s business can easily find them.

Content Marketing: Prospects can get relevant information at different stages of the buyer’s journey through valuable content.

Social Media: By taking advantage of the billions of social media users, a business can increase brand awareness and attract a huge amount of traffic to its website.

Email Marketing: Through personalized and automated emails, nurturing leads in the sales funnel becomes every time more effective.

Stakeholders will see the statistics of these numbers before handing out a funding request. The procurement of these resources means that there must be preparedness for numerous conducts that need to be ordered statutory, to keep these channels and their activities running smoothly.

Benefits of planning your next fiscal year in Q4

Q4 planning is important for your business and it’s worth taking some time to focus on it rather than letting it slide during the end of the year hustle.

It means upgrading your way of doing business, so here are some good reasons to take the time to do some business planning this fall.

-

Make better decisions about your business’s future

Use your general fund plan to keep yourself accountable for the long-term vision for your business. Is your strategy working over the long haul? Take a hard look at benchmarks, goals, and objectives. Without doing this, it’s difficult to know if what you´re doing is moving your business forward.

Measure how you’re doing and use that information to make decisions for the full year 2023 budget and even beyond. If something you’re doing is working well, you may decide to double down on it. If something isn’t working well, you’ll know what you’ve tried and what you need to tweak to get to where you want to go

-

Get a clear view of your tax situation

Part of Q4 business planning is getting a complete view of your tax situation. Looking at it ahead of time gives you options and flexibility that can change your year’s profitability and help you avoid a scramble to pay the tax bill.

It is recommended that you start with a tax advisor and once you know how the year will likely play out you still have some time to make some changes that can reduce your taxes or tax rate. You may be able to make purchases, defer income, or make other beneficial decisions. There’s nothing like going into the end of the year knowing that you have your taxes handled.

-

Have the right team in place for the future

The end of the year is a good time to think about goals and how you’re going to achieve them. It’s also a good time to think about the team you have and consider whether not it’s the team you need.

While doing your business planning, you may find that there are parts of your business that are inefficient or unnecessarily expensive or that there are things that are working very well that you’d like to do even more of. You may also find that you’re doing what you don’t to be and that some offloading could free up time for you to do the things only you can do.

A solid plan also helps contractors, freelancers, and other service providers working with you know how they can best support your business.

-

Get your team on the same page

Business planning can be a huge unifier. This is a chance for you to look at what you’ve done through the past year and then look at what you want to do in the future.

But it’s not very helpful you’re the only one who knows stats and your goals. Use business planning as an opportunity to get your entire team on the same page. It’s a chance to celebrate successes and also brainstorm ways to make your team even better in the future.

If a team member doesn’t know what they plan, encourage them to read it! This builds a team that’s working toward the same objectives together.

-

Create or refine your marketing plan

Looking at how you acquired customers is an important component of business planning because it should inform what you do in the future and how much money you spend. Here are some things to consider:

- What is the rate of repeat business?

- What is your client referral rate?

- How did you bring in cold leads cost and how many of them closed?

- Which customers are the most valuable and which are the most costly?

If you haven’t written down these metrics already, do the best you can for this year and start tracking these stats now. It’s hard to know where to put your funding sources if you don’t know what’s working and what’s not.

-

Decide if you need new assets

It can be hard to commit money towards new assets or improvements in your business. Q4 planning for your business can help you decide if it’s time to take the plunge on improvements. It can also help you see how much money you should allocate for them.

An inspector general will have a look at what’s working, what’s not working, and what you need to do to get to where you want to be. When this is set, these decisions are easier. After some business planning, it might be obvious that you should lease more office space or you should spend more money on marketing.

-

Understand the business landscape

It’s not enough to have a solid understanding of what’s happening in your business; you may also need to understand what’s happening with your competition. When you’re in the day-to-day grind of closing loans, it’s easy to forget about other lenders. That’s why it’s so important to set aside some time to take a good look at the broader landscape.

Check out what your competition is doing that’s working and what’s not. Loo at consumer trends and preferences. Look at potential disruptions or pitfalls in the market that may not be visible every day.

In the end, Q4 business planning is worth the time it takes because it reduces your risk. You’ll make better decisions, leave less put to chance, and have a clear view of the future of your business and your team.

5 different budget clarifications strategies

- Make time for budget planning

Budget planning is an opportunity to rise above your day-to-day activities.

Make it a priority to step off that treadmill and take an outsider’s perspective on your business. You will be amazed at the opportunity to embrace other opportunities and tackle the problems you see.

However, you must make it a priority by scheduling time to do it. Otherwise, your day-to-day activities will simply consume you, and the planning will never get done.

-

Involve the right people

In too many organizations, the budget planning process happens solely within the Finance Department or the chief financial officer’s office. While the executive budget is finally approved by the company president, the reality is that different people throughout your organization can enhance and inform the process.

What about the sales force? Or the business analysts?

What are their projections for future growth? Their views will make your budget projections more accurate, as well as increase commitment to making it a success.

-

Historical information is valuable

It’s about benchmarking. Your annual performance provides the baseline by which to assess your year-over-year performance.

When you are looking to the future, be realistic. Remember that the environment around you changes n can affect where you put your resources and attention.

-

Consider the variable costs of growth

Fixed costs such as rent, leased equipment and furniture are largely constant. Variable costs include salaries, communications and advertising, and marketing which can fluctuate as your agency grows.

You should project growth, but don’t forget to include the variable costs of handling that additional business. Use your past performance to calculate the relationship between growth and variable costs, then use this data to project variable costs of future growth.

-

Be continuous

Budget planning is not a one-time exercise. It’s an ongoing responsive, flexible process.

Don´t just file the budget and return to your day-to-day routine. The process of examining performance, assessing your status, and planning for the future – keep it going. As a leader, budget planning and allocating resources should be on your mind constantly. The road is a long one, always keep on a long-term perspective.

How to measure your budget planning results?

Budgets are the most useful assets that top management uses to measure actual organizational performance. Budgets are commonly perceived to exist for financial purposes only presenting numbers and figures, however, budgets can be the key tools to provide supplemental insight into how an organization is performing and why it is performing in that way.

How are budgets used to measure planning results? Here are 3 brief and simplified ways managers of agencies use a budget office to measure performance.

-

Identify significant variances

A budget variance is a difference between a budgeted amount and an actual amount of expenses or revenue. These variances could include a difference in expenses/ costs and an increase or decrease in sales/profits.

Variances can be good or bad. If the budget variance in revenue is higher than the budgeted amount or if the actual expenses are less than the budgeted amount, the budget variance is at a favorable outcome. If this scenario is reversed and revenue is less than the budgeted amount and the actual expenses are higher than the budgeted amount, it means the budgeted project needs to be reviewed as it is not running successfully or sustainably.

Budgets need to be monitored and significant variances need to be identified so that they can be investigated and managed further.

-

Analyze budget variances

Once some significant budget variances have been identified it is important for these variances to be analyzed. Without analyzing these variances no insights can be drawn from them and nothing can be done to improve or eliminate the variances to ensure the viability and sustainability of the budgeted project in question. The reasons or causes of a variance once identified are important for the organization to address as it is an opportunity to improve their operations and performance.

For example, by analyzing a budget variance the agency will be able to determine if it is a long-term or short-term problem that may need a quick fix or a permanent solution. Perhaps the retail price of the agency’s product or service may need to be increased to make up for an unfavorable variance. Perhaps sales have dropped due to economic conditions that have reduced consumer demands outside of the organization’s control. Similarly, input costs into a product or service may have increased due to economic conditions and therefore alternative arrangements may need to be made. Seasonal trends and buying patterns may also be identified if variances are monitored over a long period of time. Whatever the outcome it is important that these budget variances are analyzed so that corrective action can be taken to improve the organization’s variances.

-

Determine if the budget needs to be revised during the year

After identifying significant variances and analyzing these variances to detail the issues behind them, it is time to use the information from the analysis to revise the budget if necessary.

A budget revision is a process that allows a budget manager or a senior management team to make changes to an existing budget. A budget revision may need to be implemented in order to get a budget back on track depending on the issues identified.

For instance, a budget revision may need to trim the expenses in a budget, reallocate revenues or even incorporate finding new sources of income into the budget to satisfy the expenses identified.

Conclusion

Running an agency successfully requires that every aspect of the agency works effectively. From acquiring clients to managing employees, you need to be on top of all the vital activities.

Perhaps, one of the most important tasks is managing your agency resources such as time, money, and personnel. Follow these five vital tips to help you achieve better productivity for your agency budget.